Amazon Isn’t “Selling Cars.” It’s Rewiring Car Buying Expectations — Here’s the Dealer Play

If you’re a dealer operator, the Amazon story isn’t about whether Amazon replaces dealerships. It’s about something more practical (and more dangerous): Amazon is compressing the buyer’s tolerance for friction. And when expectations shift, your process gets judged against the new baseline.

By Craig White • Profitable Pre-Owned (PPO)

The real question dealers should ask

The question I keep hearing is: “Is Amazon actually going to matter in automotive?”

Here’s the better question: What happens to your close rate when shoppers start expecting car buying to feel like every other purchase?

Because Amazon doesn’t have to “take over the industry” to create pain. It only has to train customers that the process should be clearer, faster, and lower-friction than what many stores deliver today.

What’s new with Amazon Autos (and why it matters)

Over the last year, the Amazon Autos narrative shifted from “pilot” to “platform behavior.” The headlines can feel scattered, but the pattern is consistent.

- Marketplace expansion into Used + CPO: Amazon Autos broadened beyond new-car listings into used and certified inventory.

- OEM-backed CPO participation: Ford Blue Advantage CPO inventory can be shopped/financed/purchased through Amazon Autos (with pickup at participating dealers).

- In-car experience land grab: Amazon is also pushing deeper into the cabin — voice, infotainment, and media integrations.

Dealer takeaway: Amazon isn’t chasing “dealer profit pools.” It’s chasing habit formation — making a car purchase feel more like a normal online checkout.

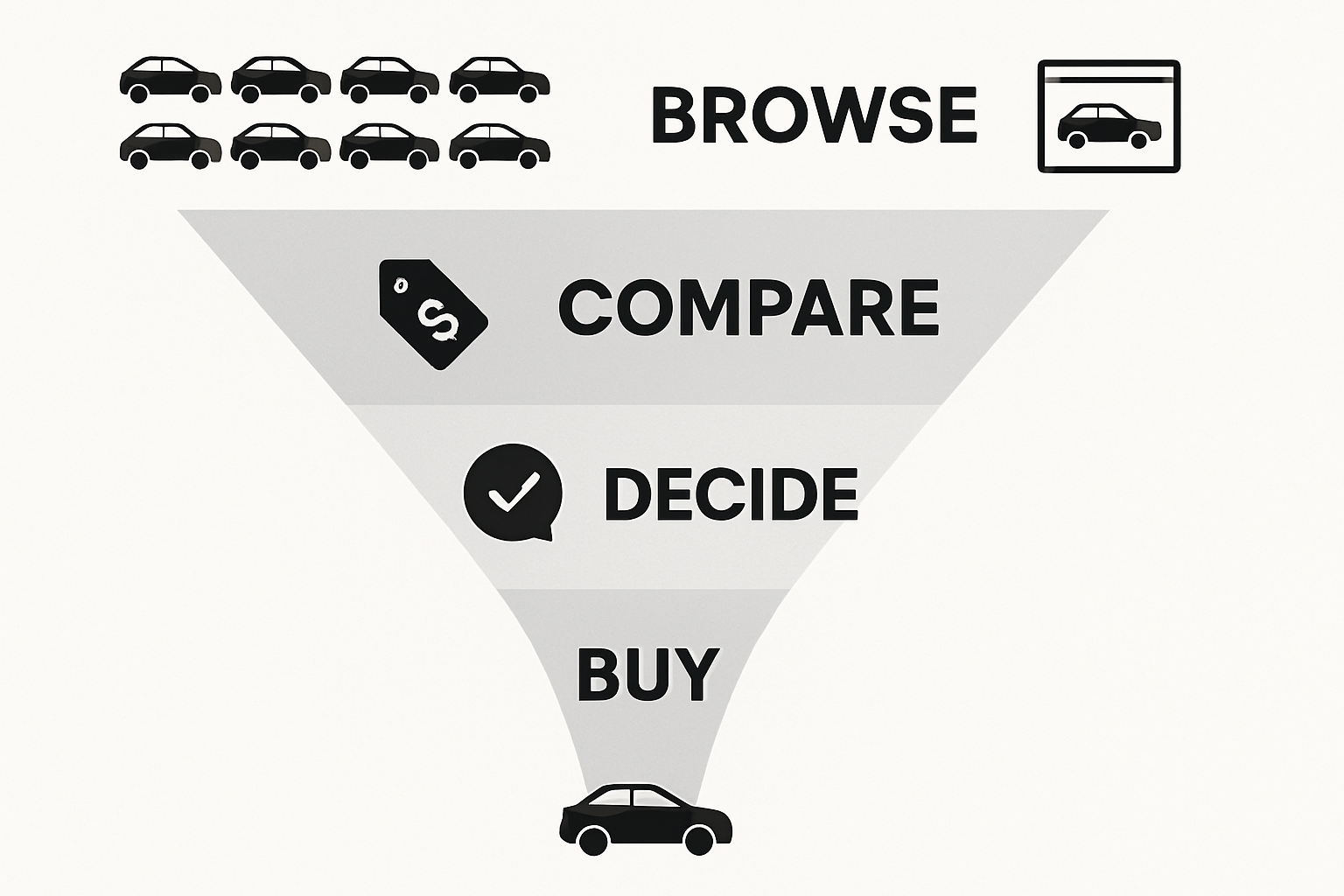

The shift dealers will actually feel: funnel compression

Here’s what changes when shoppers get trained on a lower-friction buying path:

- More “silent shoppers” convert faster — but only if your listing answers real questions.

- Price gaps get judged harder — “close enough” pricing stops working on aged units.

- Response time becomes a deal-breaker — the expectation becomes immediate, not “when the BDC gets to it.”

- Merchandising becomes the new closing — your VDP is your first test drive now.

Translation: This is less about Amazon as a sales channel and more about Amazon as the expectation setter.

The dealer plays: win by removing friction faster than your market

The stores that win in 2026 won’t be the ones trying to “out-Amazon” Amazon. They’ll be the ones that build an operating system around three non-negotiables:

1) Pricing cadence (smarter moves, fewer times)

Stop random price slashing. Start disciplined pricing moves tied to market shifts, VDP behavior, and age strategy. Your goal is to create a real gap — not a fake one.

2) Listings that close (your VDP is your top salesperson)

If your descriptions are thin, repetitive, or missing the “why buy this one” story, shoppers bounce. Treat your listings like a sales process — proof, clarity, confidence.

3) Speed-to-lead that’s truly fast

The “Amazon effect” raises the bar on response time. Build a repeatable workflow: alert → assignment → first response → follow-up plan — every time, every lead.

When you nail these three, your store feels “easier to buy from” than your competitors — and that’s the advantage that compounds.

Want the dealer version of what’s changing (before it hits your grosses)?

Join the PPO Brief — a fast weekly email built for used-car operators. No fluff. Just the market shifts, pricing signals, and merchandising plays that move metal.

- Pricing cadence plays (what’s working right now)

- Inventory pockets getting soft — before your lot feels it

- VDP + SRP actions that lift leads without discounting

Tip: Add this CTA block to older high-performing posts too — it converts best when readers are already nodding along.

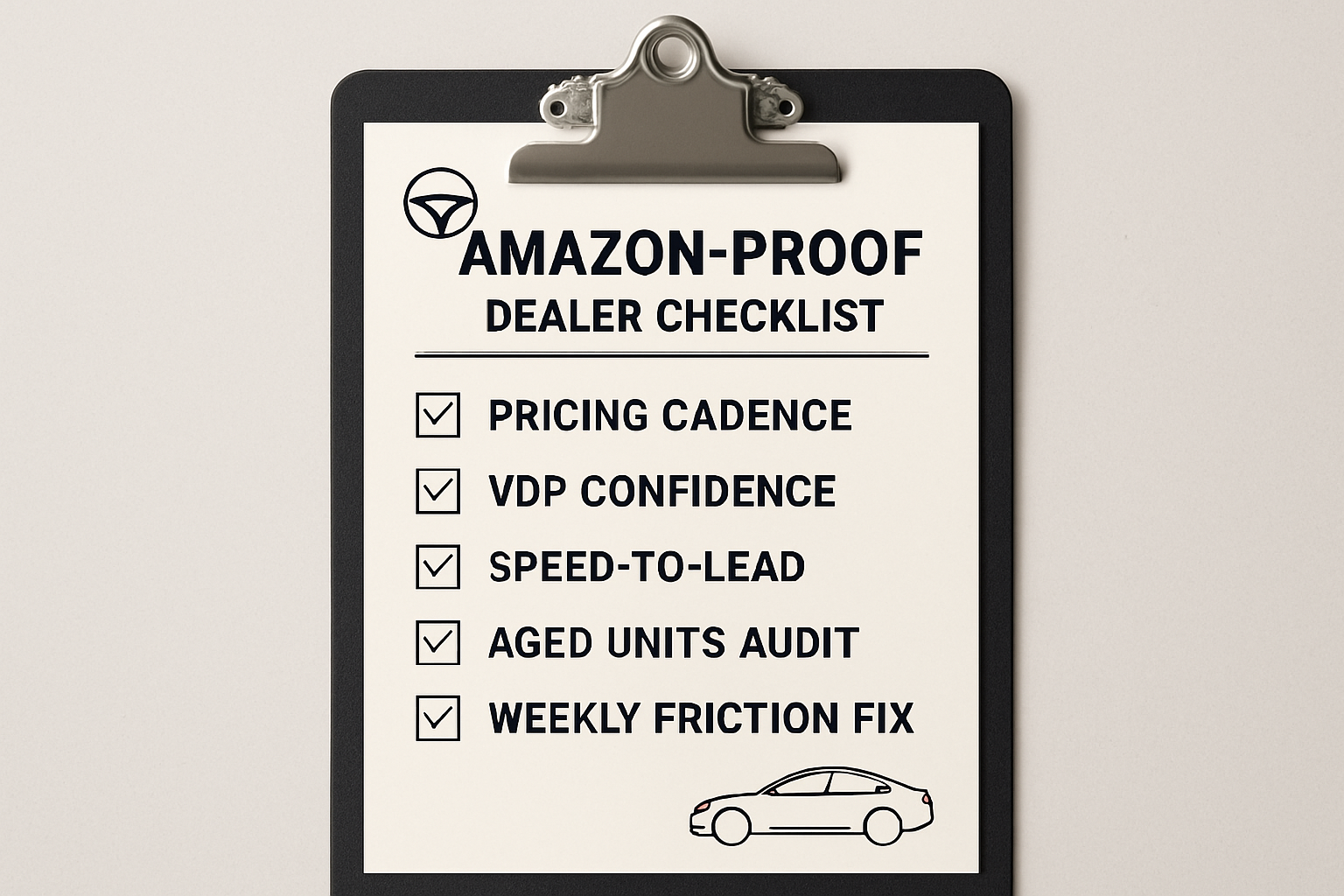

A simple “Amazon-proof” checklist for your used-car operation

Here’s a quick field checklist you can run this week. The goal is to remove friction and increase buyer confidence without relying on deeper discounts.

- Audit your top 25 aged units: Are they priced to create a real gap — or are they “close enough” and stuck?

- Fix the VDP confidence killers: Thin descriptions, missing proof points, weak photos, unclear condition notes.

- Standardize a pricing cadence: Fewer moves, smarter timing, documented triggers.

- Speed-to-lead measurement: Track first-response time and appointment-setting rate (not just “we replied”).

- One friction-removal change per week: Compounding beats chaos. Small wins stack fast.

Amazon doesn’t have to be your competitor to be your problem. The expectation shift is already happening — and the dealers who build systems now will take share later.

The question to ask your team this week

If a shopper compares our VDP experience to their easiest online purchase this month… do we win or lose?

If that answer makes you uncomfortable, good. That discomfort is the signal. Now turn it into a process.

.png)

-1.png)

.png)

-3.png)