If you’re on a used-car desk every day, this probably won’t surprise you.

2025 looked solid on paper. Sales were decent. Inventory finally normalized. OEMs caught their breath.

But here’s the truth most headlines won’t say out loud: the momentum is already slowing. And if you wait for the “official slowdown” to show up in the data, you’ll already be behind.

This isn’t a crash. It’s something more dangerous: a quiet slowdown where small mistakes get expensive.

- 2026 won’t scream “recession.” It’ll whisper — and punish late moves.

- Exposure is the battleground. Velocity softens → aging gets expensive fast.

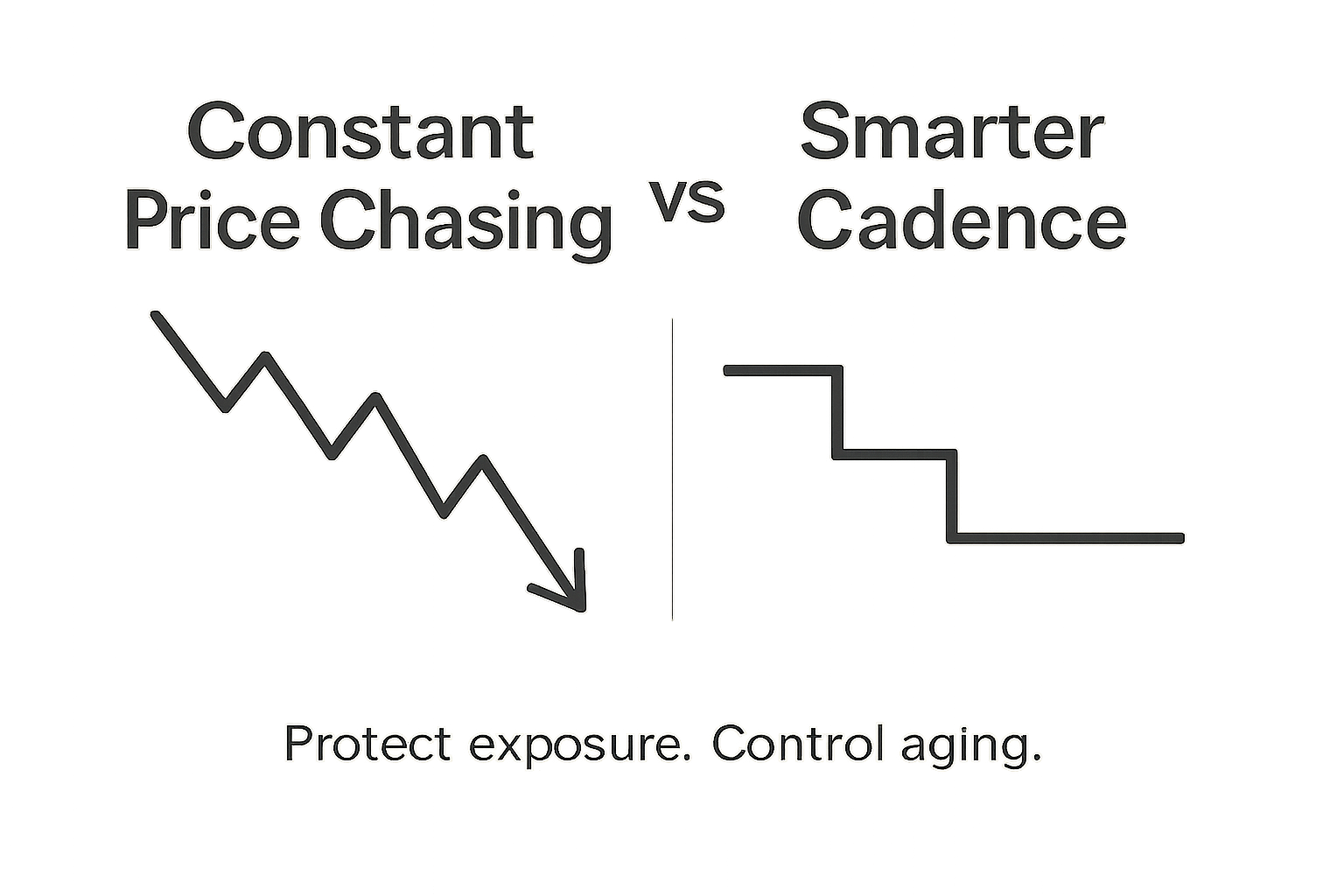

- Fewer, smarter price moves beat constant chasing (cadence matters as much as price).

- Segment discipline wins. Manage by bucket, not store averages.

- Early aggression protects gross. Late cuts protect nothing.

![]()

What the early signals are telling us

Across the industry, the signs are consistent:

- OEMs are guiding more cautiously

- Incentives are getting harder to fund (and shoppers feel it)

- EV demand is uneven without subsidies

- Affordability is still stretched (payments, rates, insurance)

- Buyers are holding cars longer — especially subprime and near-prime

In other words, the easy volume is gone. The next 12–18 months won’t reward stores that rely on “set it and forget it” pricing, weekly market reviews, or hope-based aging strategies.

Why this matters more for dealers than anyone else

When sales slow, the problem isn’t traffic. The problem is exposure.

Slower markets punish:

- Over-aged units

- Late price reactions

- Cars bought without a clear exit

- Inventory that only works if the market cooperates

When velocity drops, pricing cadence becomes the edge — not just price. Dealers who adjust earlier protect gross. Dealers who wait end up chasing the market down… one price cut at a time.

What smart dealers are doing differently right now

The best operators I talk to aren’t panicking — but they are tightening up. They’re:

- Making fewer, smarter price moves (not constant chasing)

- Reviewing inventory by segment, not just store averages

- Watching days-to-first-click, not just days-in-stock

- Getting more aggressive earlier instead of slashing later

- Treating used inventory like a portfolio, not a parking lot

The common thread?

They’re reacting to signals, not headlines.

Get The PPO Brief (Free)

If you want to stay ahead of the market before it shows up in your aging report, join The PPO Brief. One email each week with the signals dealers are actually using: pricing pressure, segment shifts, and what to adjust now.

- What’s tightening vs. cracking (by segment)

- Where pricing cadence is winning right now

- Operator takeaways you can apply the same day

No fluff. No vendor spin. Just the weekly read that keeps your inventory decisions tight.

The real risk in 2026

The biggest risk this year isn’t that sales slow. It’s that they slow just enough to hide bad decisions until they pile up.

That’s when you look up and realize:

- Aging crept higher

- Gross quietly eroded

- Turn slipped

- And the auction became the exit plan again

This market won’t scream at you. It will whisper — and charge interest.

Final thought

2026 isn’t about selling fewer cars. It’s about managing risk better than the dealer down the street.

The stores that win won’t be the loudest. They’ll be the most consistent.

— PPO / Profitable Pre-Owned

-1.png)

-1.png)