Why Smarter Pricing Cadence Is Beating Constant Price Chasing Right Now

Buyers are watching price history more closely, and reactive pricing is training shoppers to wait. Here’s what disciplined operators are doing instead.

Over the past few weeks, a clear pattern has emerged across used-car listings: stores making fewer, intentional price moves are outperforming those chasing the market daily.

This Morning Market Update breaks down what’s working right now — and how to build pricing cadence that protects trust while still keeping inventory moving.

Market Snapshot

- Retail demand is steady, but shoppers are more deliberate before submitting leads.

- SRP → VDP clicks are holding, while buyer evaluation time is trending up.

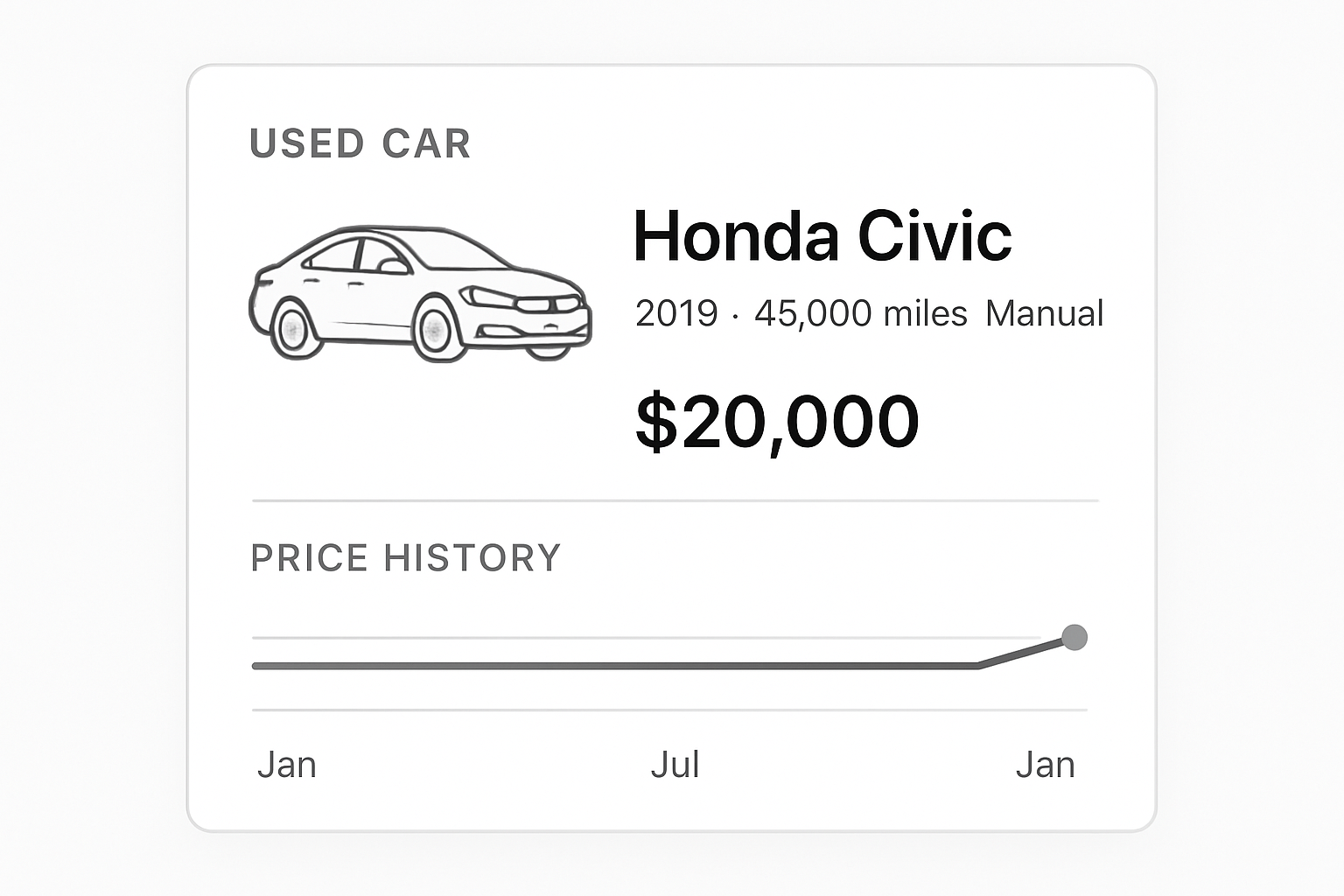

- Price-history transparency is reshaping behavior faster than most desks realize.

What’s Breaking Down

Many dealers are stuck in reactive pricing mode:

- Price changes every 24–48 hours (before the listing collects meaningful data)

- Adjustments driven by emotion or screenshots instead of signals

- Listing volatility that erodes trust and teaches shoppers to wait

This doesn’t create urgency — it creates hesitation.

What’s Working Instead

Top-performing stores are shifting to pricing cadence discipline:

- Fewer moves, backed by real engagement behavior

- Letting listings breathe long enough to measure response

- Using price changes to confirm a plan, not replace one

PPO rule: Pricing is a signal — not a reflex.

PPO Rule #2: Pricing Cadence Beats Price Chasing

The stores winning right now aren’t changing prices more — they’re changing them with intent. Cadence means your price moves are timed, measured, and tied to behavior — not emotion.

Operator checklist (use this before your next price change):

- What signal triggered this move? (SRP → VDP, VDP depth, lead rate, close rate)

- Has the listing “breathed” long enough to collect meaningful shopper behavior?

- Is this move part of a plan — or a reaction to a screenshot/competitor?

- Will the change increase clarity for the shopper — or create more noise?

Get the PPO Brief

Weekly used-car market signals — distilled for operators. Pricing behavior, inventory pressure, and market moves in one fast Monday read.

Join the PPO Brief →No spam. Just market intelligence + operator tactics.

.png)

.png)

.png)