Carvana’s Quiet Franchise Grab — And What It Means for the Future of Brick-and-Mortar Dealerships

While everyone is watching Amazon enter auto retail, the real disruption is happening somewhere else entirely — Carvana is quietly acquiring franchise dealerships.

This isn’t a distressed-assets play. It’s not a market-share play. And it’s not a “fix the traditional model” play. Carvana is securing the one thing it never had: the physical footprint OEMs still rely on to deliver modern automotive retail.

Here’s why that matters — and why it may redefine the next decade of dealer strategy.

The Real Prize: Controlling the Customer Gateway

Franchise stores possess three assets Carvana could never replicate digitally:

- OEM brand access — the contractual right to sell new vehicles

- Service infrastructure — a physical backbone for retention

- Local presence — credibility, delivery efficiency, and customer touchpoints

With franchise stores, Carvana instantly unlocks a new business model — one where dealerships become the activation hubs for OEM subscription features, OTA updates, and paid software upgrades.

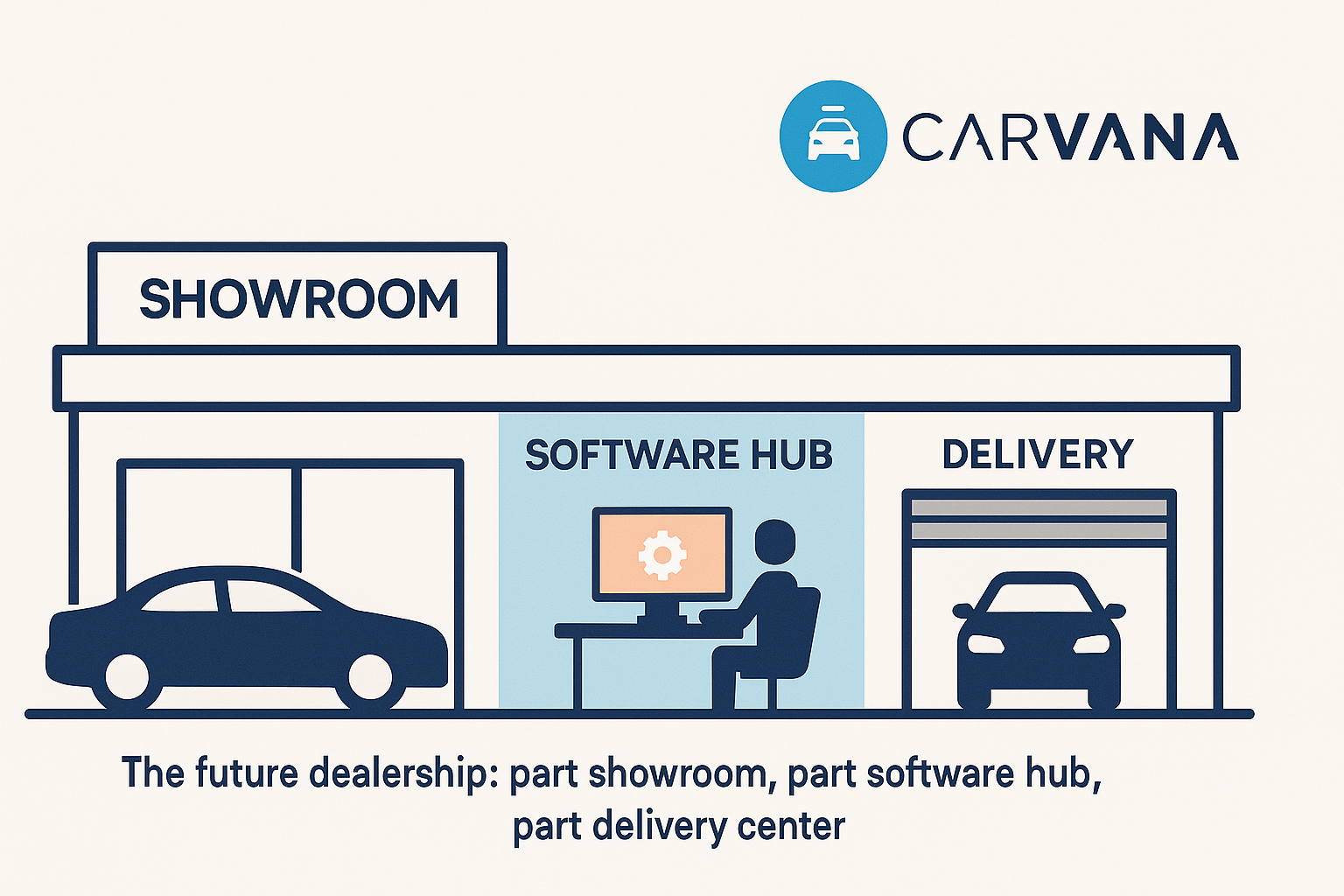

Why Physical Nodes Still Matter in a Digital-First Retail Model

Even as cars become software-driven, the OEM-to-consumer relationship still depends on local infrastructure:

- Test-drive and experiential touchpoints

- Vehicle delivery and returns

- Service, warranty, and reconditioning capacity

- Customer onboarding into apps, subscriptions, and OTA features

Carvana understands something many traditional operators overlook: the future profit pool isn’t just in selling the car — it’s in controlling the moment the customer meets the brand.

PPO BRIEF BONUS

The Future Dealer Playbook

What happens when dealerships stop selling cars and start activating customers? Get the strategic checklist operators are using to prepare for 2026 and beyond.

Get the Playbook →The Best Buy Parallel Dealers Should Study

When Best Buy realized it couldn’t win on price, it reinvented itself by monetizing its space — transforming stores into premium real estate for Apple, Samsung, Microsoft, and others.

The result: a market comeback, stronger margins, and a new identity.

Dealers may face the same inflection point.

The Future: Experience Real Estate, Not Just Dealerships

This is the shift few are prepared for. The value of a dealership may soon depend more on:

- Its ability to activate subscriptions

- Its service bay capacity

- Its OEM-branded experience zones

- Its role in the digital-to-physical customer journey

Carvana sees this future clearly. Traditional dealers who adapt will win. Those who cling to the old bundle — front-end margin, F&I, and passive service retention — will fall behind.

📘 Get the PPO Brief + The Future Dealer Playbook

Join the Profitable Pre-Owned Brief and get immediate access to The Future Dealer Playbook — a strategic checklist for operators preparing for the next decade of automotive retail.

- ✔ How dealerships become experienced real estate

- ✔ Where software replaces traditional F&I profit

- ✔ Why service is now a growth engine, not support

- ✔ Inventory strategy after the Covid-era distortions

Free. Written for operators. Delivered instantly.

-1.png)

.png)