PPO Morning Market Update: Luxury Softening, Used EVs, and Fast-Trust Gaps

By Craig White · PPO Morning Market Update

This week’s PPO Morning Market Update highlights softening luxury demand, selective strength in used EVs, a clear shift toward value-focused shoppers, and a growing performance gap driven by merchandising quality. If you want to stay ahead of the market instead of reacting to it, these are the signals to watch.

1. Luxury Is Softening Again

Highline and near-luxury segments are feeling more pressure. Days-to-turn are stretching, shoppers are more sensitive to small price changes, and VDP engagement isn’t matching the inventory cost dealers are carrying. Nameplates alone are no longer enough to guarantee demand.

The takeaway: get honest about your exit strategy on aging luxury. Decide now whether you’re going to re-price, re-merchandize, or exit, instead of letting high-cost units quietly age out of your profit window.

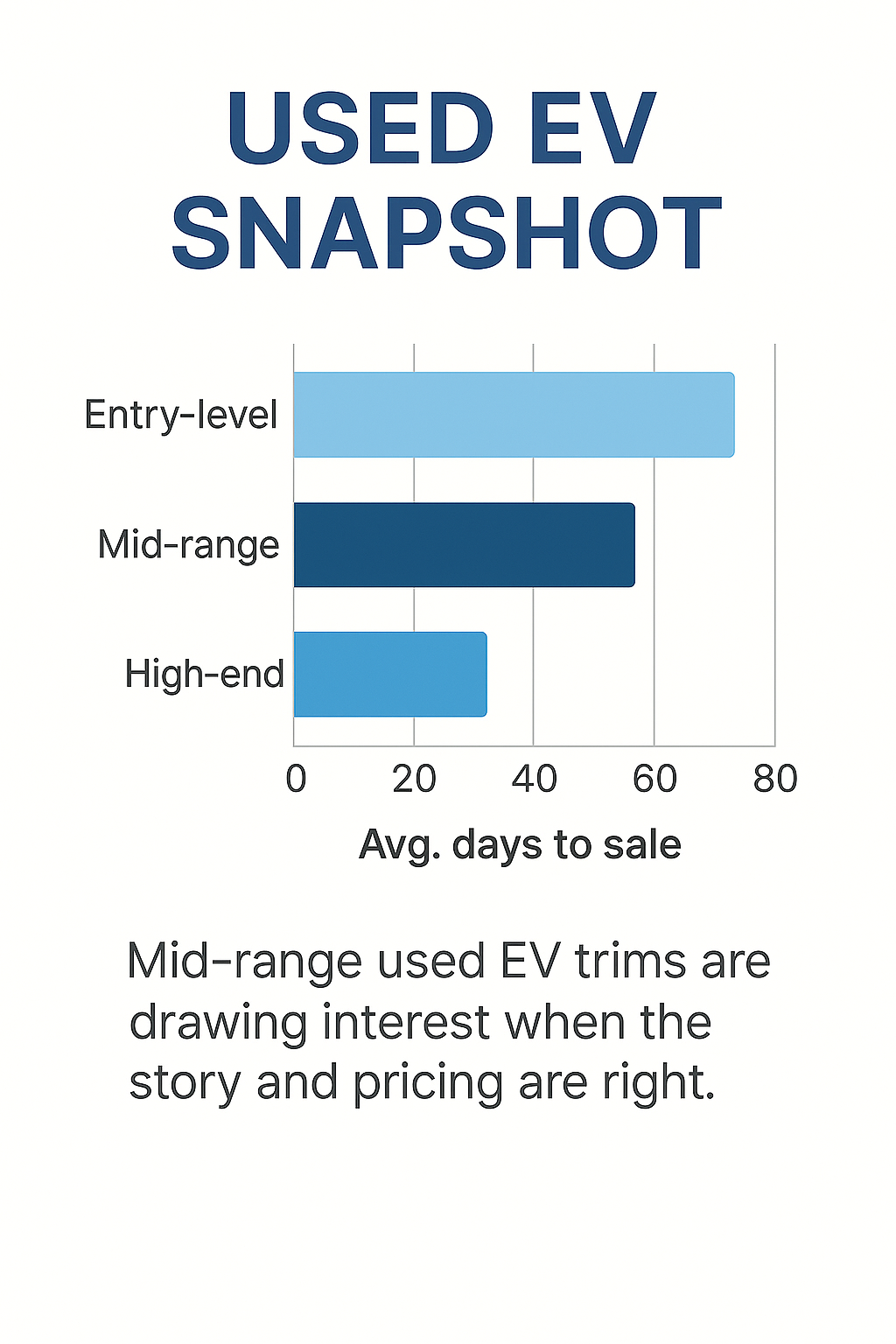

2. Used EVs Are Stabilizing—Selectively

Used EV volume is still uneven, but certain trims are showing consistent activity when priced correctly: Bolt EUV, Kona EV, Leaf SV+, and Ioniq Electric continue to attract value-focused shoppers. Over-optioned or high-mile premium EVs are still a tougher retail story.

Your advantage is in how you frame the EV story: battery health, warranty coverage, recon, and real-world operating costs. When those are clear, used EVs become a rational value play instead of a science project.

3. Shoppers Want Value and Clarity, Not Hype

The current consumer mindset is simple: don’t sell me a dream, show me the numbers. Shoppers are using marketplaces to benchmark prices, but they’re making decisions based on trust and clarity.

Listings that clearly explain reconditioning, ownership cost, and trim-level value are winning the first click even when they aren’t the cheapest unit on the page. Trust is the new pricing power.

4. Photo and Recon Quality Are Driving SRP → VDP Performance

Marketplace algorithms are rewarding fast-trust listings: clean photos, clear recon notes, and honest condition descriptions. Weak photo sets and thin comments are getting buried long before a human ever sees them.

If you want more leads without buying more traffic, start with your SRP-to-VDP funnel. Fix photo quality and comments on the units that already have high SRP views but weak VDP engagement. That’s low-hanging fruit.

5. Dealer Action Plan for the Week

- Audit luxury inventory for aging units and define a clear pricing or exit plan.

- Reframe used EVs with battery, recon, and ownership-cost clarity instead of just price.

- Refresh comments to tell a value story, not just stack clichés and exclamation points.

- Prioritize photo and recon upgrades on high-SRP, low-VDP units first.

The dealers who treat merchandising as a fast-trust engine—not a checkbox exercise—will keep winning the first click, the first call, and the deal.