The Quiet Collapse of EV Trade-In Values (and What Dealers Can Do About It)

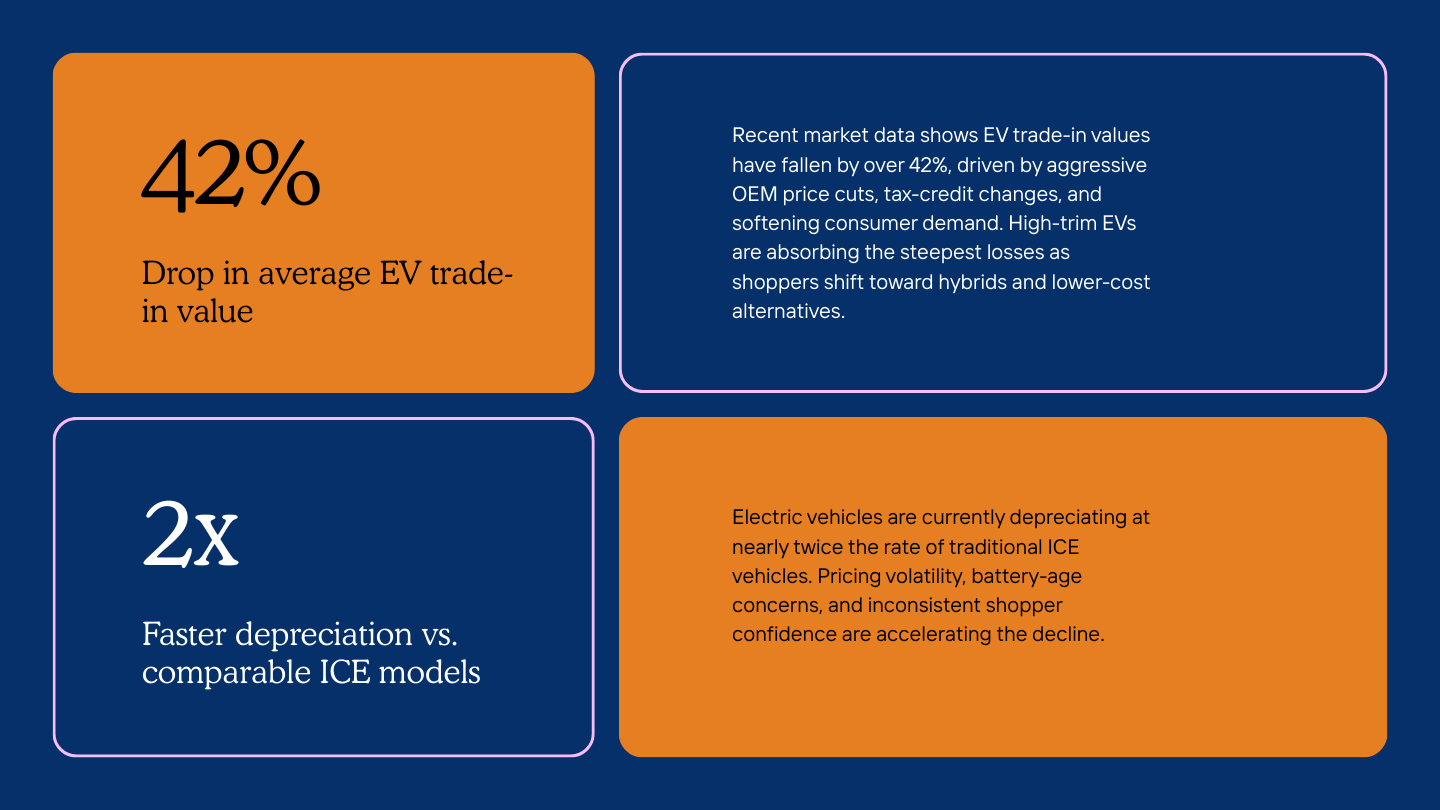

EV trade-in values are falling faster than most dealers expected. High-trim models, early technology generations, and recent OEM price cuts have created a valuation reset — and it’s catching many stores off guard. This post breaks down why it’s happening and how to avoid the most common appraisal mistakes.

Why EV Values Are Slipping

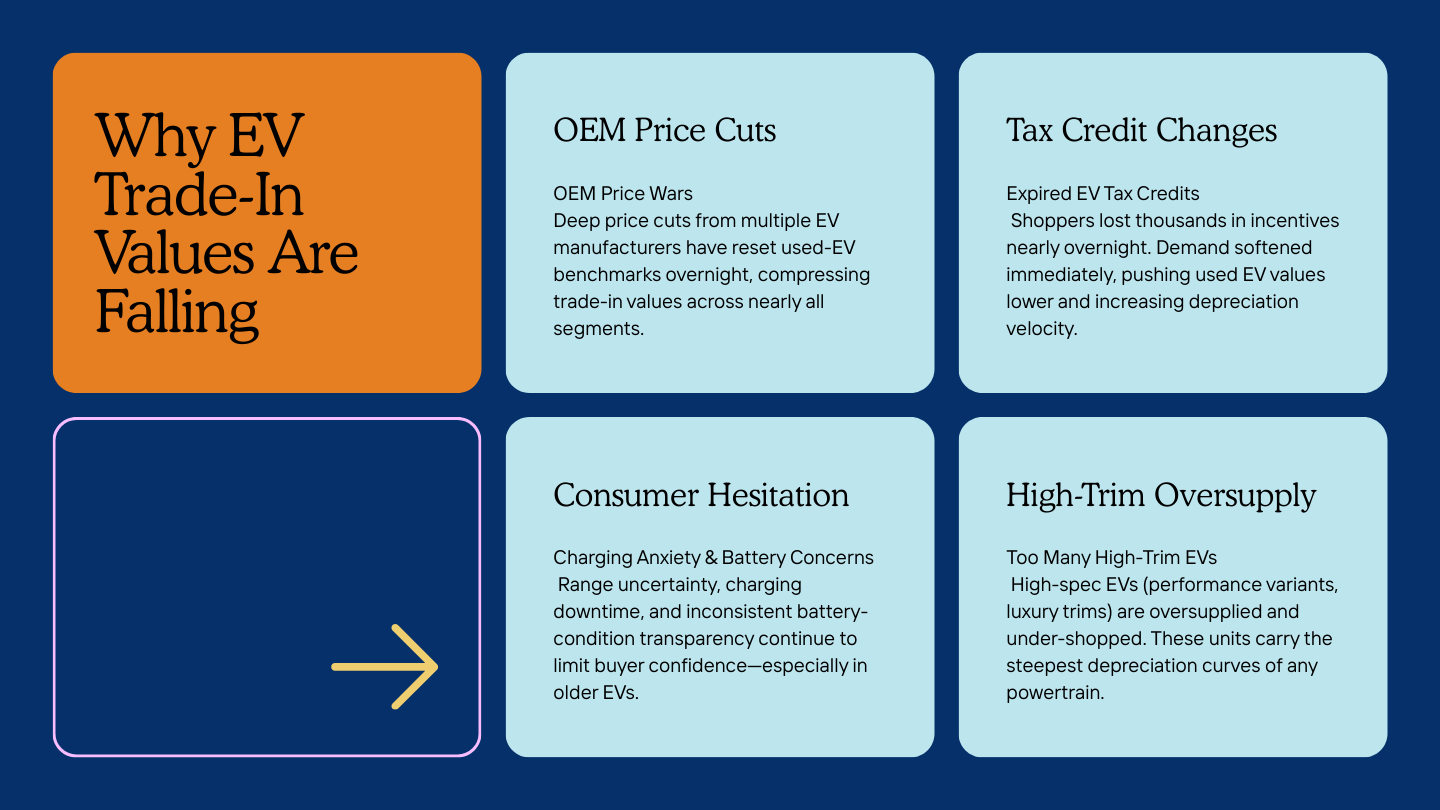

Multiple forces are pushing EV prices downward:

- Tax credit expiration triggered a demand dip.

- OEM price wars reset new-EV benchmarks overnight.

- Consumer hesitancy around range, charging, and battery longevity.

- High-trim EVs suffer from over-equipment and low demand.

Stay Ahead of the Used-Car Market

I break down shifts like this every Monday in The Profitable Pre-Owned Brief — no hype, no fluff, just the signals dealers need to see before they show up in the numbers.

Join the Profitable Pre-Owned Brief

The Danger for Dealers: Appraising EVs Like ICE Vehicles

Appraising EVs using traditional ICE formulas is risky. EVs carry unique depreciation patterns, software considerations, and recon variables that can swing values thousands of dollars.

High-trim EVs pose the biggest risk — they often carry equipment the market won’t pay for and suffer the steepest depreciation curves.

The Opportunity: Mid-Range EVs With Protected Pricing

Not all EVs are equal. Mid-range trims — the ones closer to “value EV” territory — are holding up far better than high-spec versions.

- Bolt EUV

- Nissan Leaf SV+

- Kona EV

- Ioniq Electric

Pair this with strong reconditioning transparency, and you can retail these units without the volatility of higher-end EVs.

PPO Take: Protect Your Store With a Smarter EV Appraisal Process

EV valuations won’t normalize until price wars ease and consumer confidence stabilizes. Until then, appraise with caution, focus on mid-range trims, and use a battery-first recon and pricing approach.

Download the EV Appraisal Risk Checklist

Battery checks, pricing flags, recon items, and risk indicators — all on one page.

Download the Checklist

.png)

.png)