PPO Morning Market Update — Luxury Softening, Used EV Stabilizing & Fast-Trust Gaps

December 5, 2025

The market isn’t weakening — it’s reshuffling. Luxury segments are softening, select used EV trims are stabilizing, and fast-trust merchandising is emerging as the new SRP→VDP lift lever.

1. Luxury Demand Is Softening — Quietly but Noticeably

Luxury pricing reached its ceiling in Q4. Now the signals are showing up in:

- German sedans and midsize luxury SUVs sitting past 45–55 days

- Payment-sensitive luxury shoppers cross-shopping down-segment

- OEM incentives quietly creeping upward on new-car luxury

Dealer Move: Reprice aggressively over 45 days and tighten trim merchandising. Luxury shoppers compare harder than any other segment.

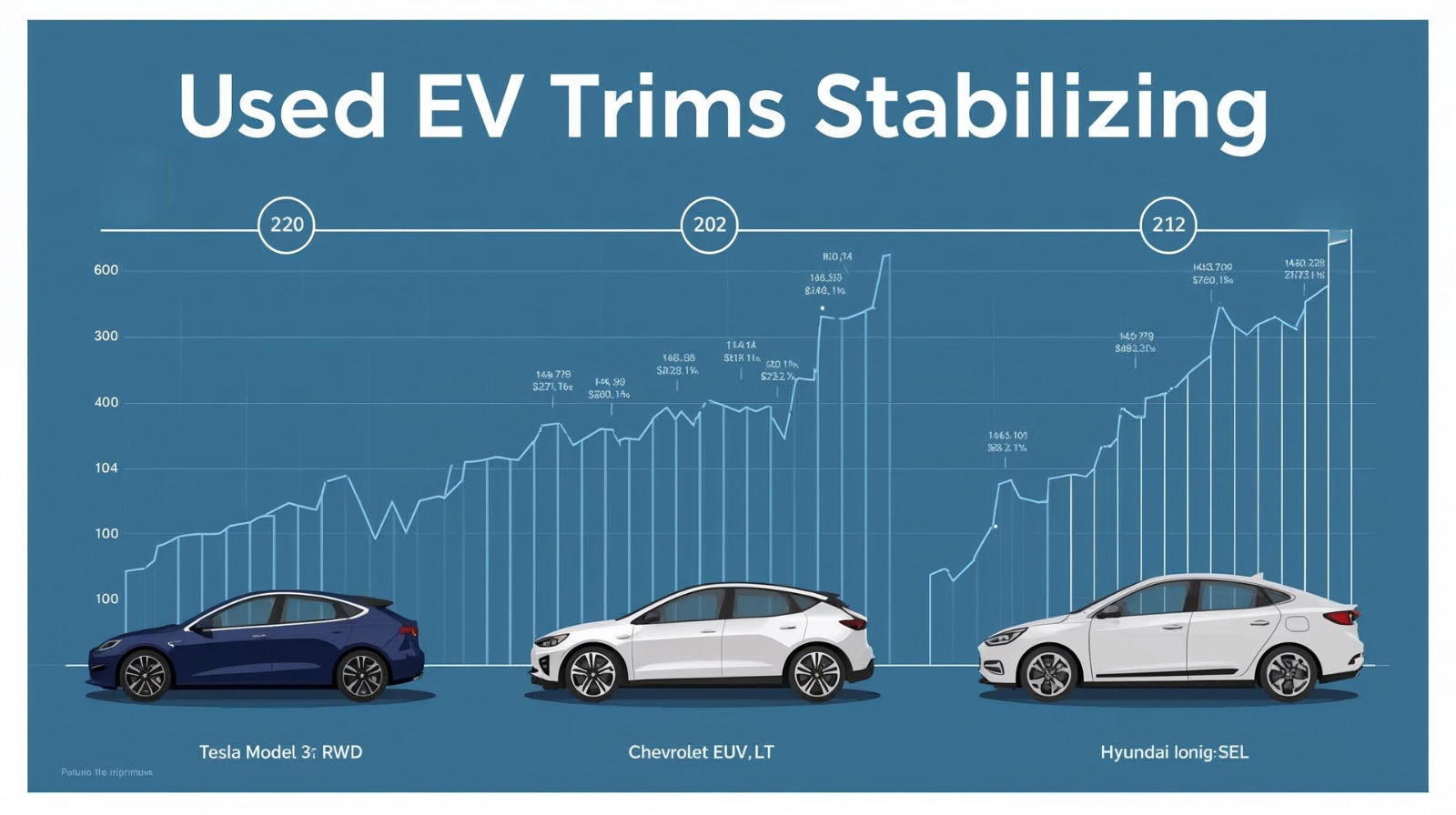

2. Used EVs Are Stabilizing — But Only in the Right Trims

The EV crash is over for trims that meet realistic shopper expectations:

- Tesla Model 3 RWD (23–30K sweet spot)

- Bolt EUV LT (affordable, reliable range)

- Ioniq 5 SEL (tech + comfort without the price spike)

Base trims with weak real-world range still struggle unless deeply discounted.

.png)

3. Fast-Trust Merchandising Is the SRP→VDP Advantage in December

Shoppers are burned out on fluff. They want transparency and clarity:

- Clean photos

- Recon transparency (show what’s been fixed)

- Trim accuracy (no more Prius 1 mislabeled as a Prius 4)

- No missing features or packages

- Pricing tied to LMDS and vehicle condition

Stores running a fast-trust strategy are seeing 15–35% VDP lift depending on the segment.

The Bottom Line

December isn’t soft — it’s shifting:

- Luxury is softening (adjust early, not at 60 days).

- Used EVs are stabilizing in the trims that make sense.

- Fast-trust merchandising is the easiest SRP→VDP win available.

Dealers who clean their data, price luxury realistically, tell a recon story, and lean into EV trims with real demand will win the month.

📘 Download the PPO Fast-Trust Merchandising Checklist

Get the 7-step checklist dealers are using to boost VDP engagement 15–35%.

Download the Checklist

.png)