Why Affordability Is the #1 Auto Story Going Into 2026

Affordability — not EVs, not technology, not production targets — is the defining auto industry story heading into 2026. Consumers are stretched thin, interest rates remain elevated, and tariffs are adding pressure across the supply chain. Dealers who understand this shift will win the first click, the showroom visit, and the deal.

The Payment Wall Has Arrived

New-car affordability is at its breaking point. With loan terms stretching to 7–10 years and monthly payments still hovering at record highs, buyers are recalibrating. The move down-market is accelerating, and used vehicles under $25K have become the most competitive segment on dealership lots.

Tariffs + Supply Chain = Higher Costs Everywhere

Tariffs on parts and imported vehicles, combined with lingering supply-chain disruptions, are pushing production and recon costs upward. Even though the chip shortage is mostly behind us, elevated materials and logistics costs remain baked into OEM pricing.

Shoppers Are Redefining “Good Enough”

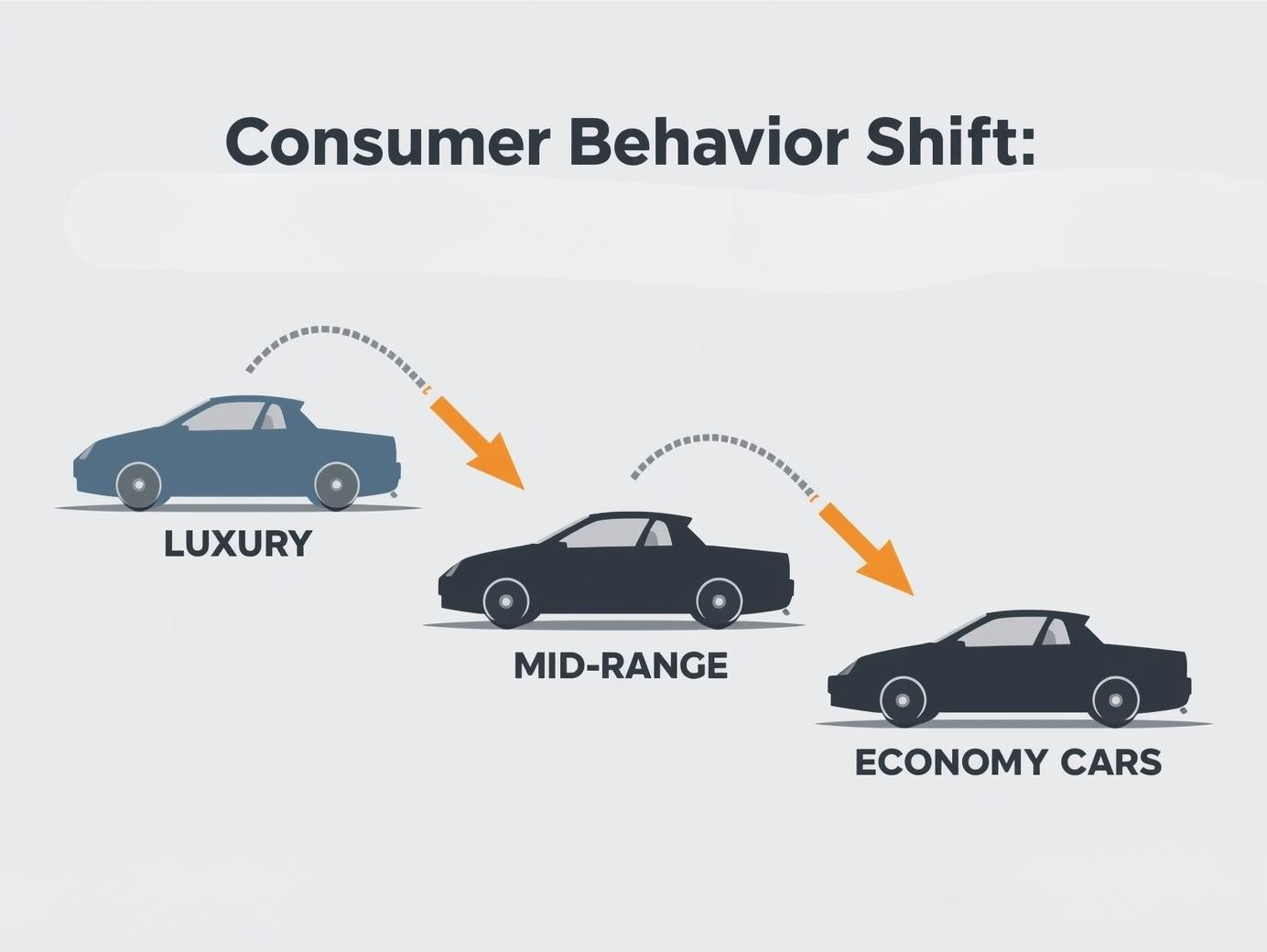

Value shoppers are moving down the funnel:

- Older-model used vehicles

- Hybrids instead of EVs

- Reliable ICE models with a lower total cost of ownership

The luxury softening trend continues, with high-trim models showing the steepest depreciation — while practical crossovers and fuel-efficient models are holding firm.

Dealer Impact: Affordability Becomes the Battleground

Dealers who adapt will win. The market is rewarding:

- Faster merchandising

- Trim clarity and feature accuracy

- Transparent recon storytelling

- Pricing strategies that beat IMV friction

PPO Take: What to Source in the Affordability Era

- Reliable under-$25K vehicles

- Mid-mileage hybrid crossovers

- Practical ICE sedans and hatchbacks

- Value trims (avoid over-equipment)

Use LMDS, Scarcity Index, and fast-trust merchandising to increase first-click conversion and shorten your time-to-lot.

Download the Fast-Trust Merchandising Checklist

Give your used vehicles a conversion advantage — photos, trim clarity, recon story, transparency.

Download the Checklist

.png)

-1.png)