Used EVs Are Reshaping the Wholesale Market — And 2026 Will Be the Tipping Point

Insights pulled from Cox Automotive / Manheim’s latest MUVVI call presentation (Jan 8, 2026)

The used-vehicle market didn’t just “move” in Q4 — it signaled what’s coming next.

The latest Manheim Used Vehicle Value Index (MUVVI) call shows a clear reality: used EVs are no longer behaving like a niche segment. They’re separating from ICE vehicles in key wholesale metrics — right as a major influx of used EVs is expected to enter the market in 2026.

Cox’s Strategic Move Most Dealers Missed

Cox Automotive’s acquisition of Alliance Inspection Management created the largest off-site inspection force in the industry, significantly enhancing Manheim’s inspection capabilities.

This matters because EVs bring a different kind of risk into the lanes — and dealers need more clarity, not less:

- Battery-related uncertainty directly impacts value confidence

- Range and condition questions are harder to “eye-test” than ICE

- Inspection scale and consistency = faster, more confident buying decisions

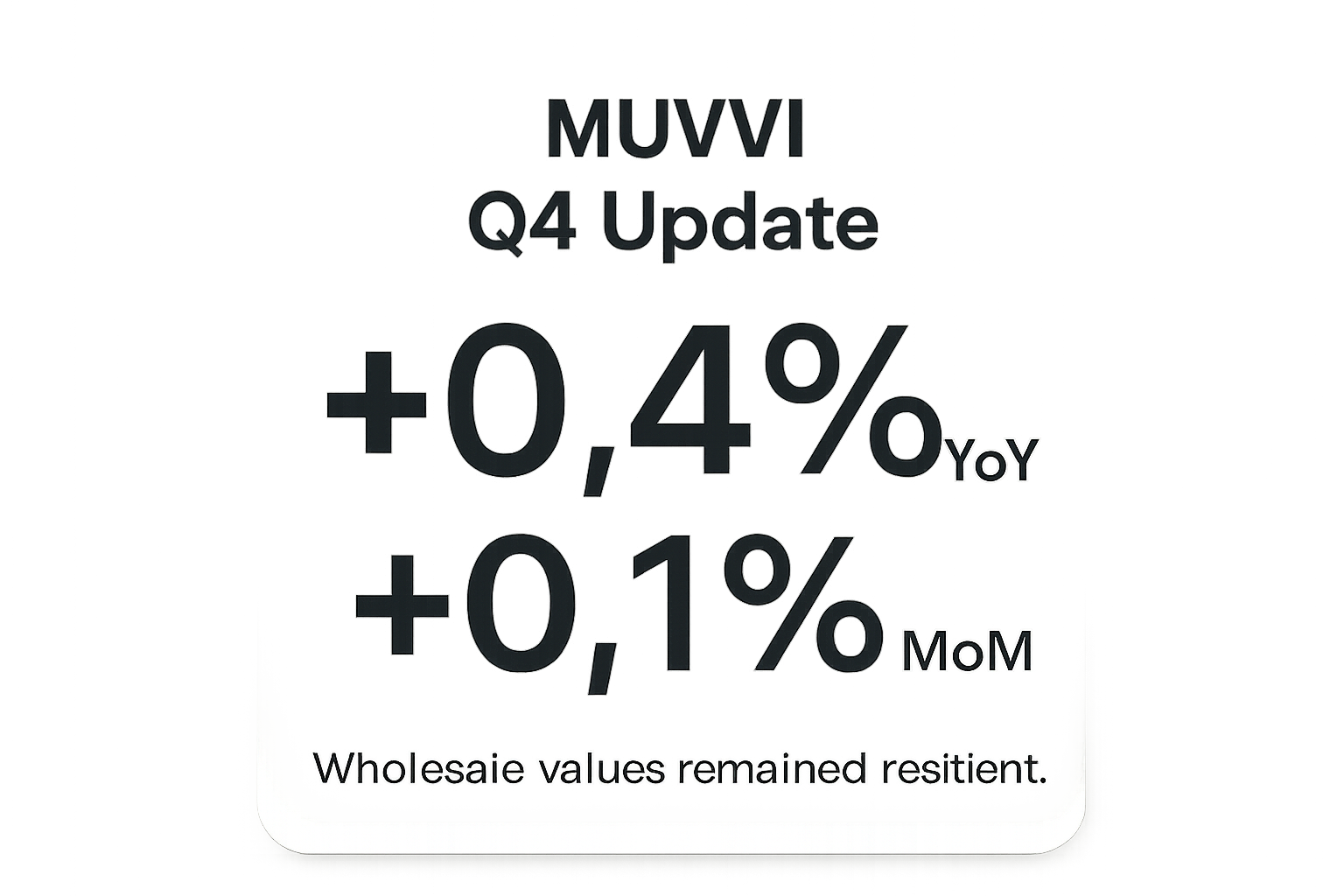

Retail Was Mixed — Wholesale Stayed Resilient

The report noted new retail sales were muted, while used declined (quarter-over-quarter), even as used EV retail sales were up year-over-year.

Wholesale headline: MUVVI was higher by 0.4% versus last December and rose 0.1% in the month.

EVs Are Separating From ICE — And the Gap Is Widening

The year-end data makes the divergence hard to ignore:

- EV Index finished +2.5% year-over-year

- Non-EV Index increased +0.4% year-over-year

- All primary segments show lower values YoY, while EVs are up the most against last December

That’s the big topic heading into 2026: EVs are outperforming as the market prepares for a much larger supply wave.

Want weekly used-car market signals like this?

The PPO Brief breaks down wholesale, retail, and inventory trends dealers can actually use — without the noise.

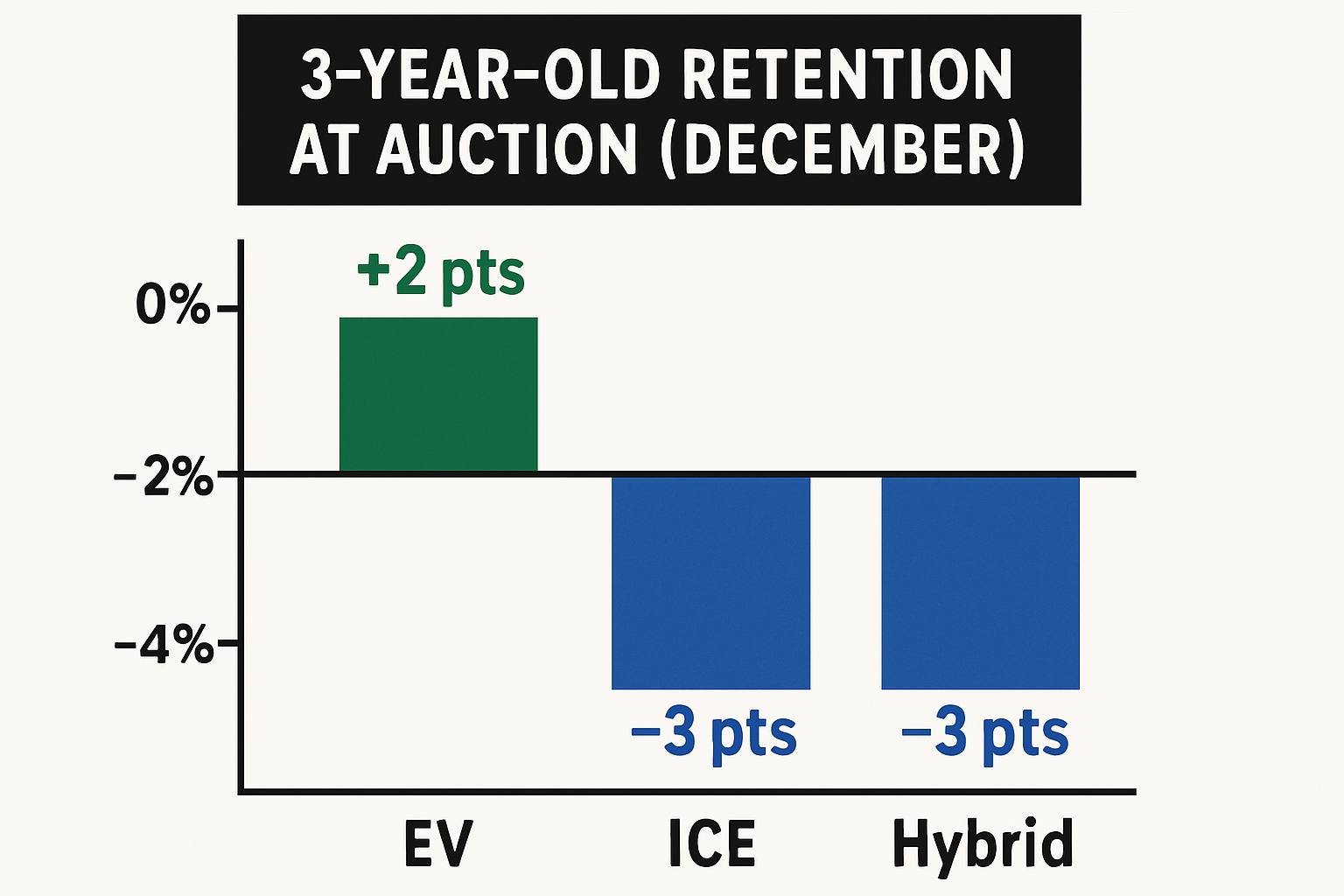

Join the PPO BriefRetention by Fuel Type: EVs Improved While ICE and Hybrid Slipped

On 3-year-old retention at auction, the monthly direction was telling:

- EV values rose 2 points in December

- ICE and hybrid retention both fell by 3 points in the month

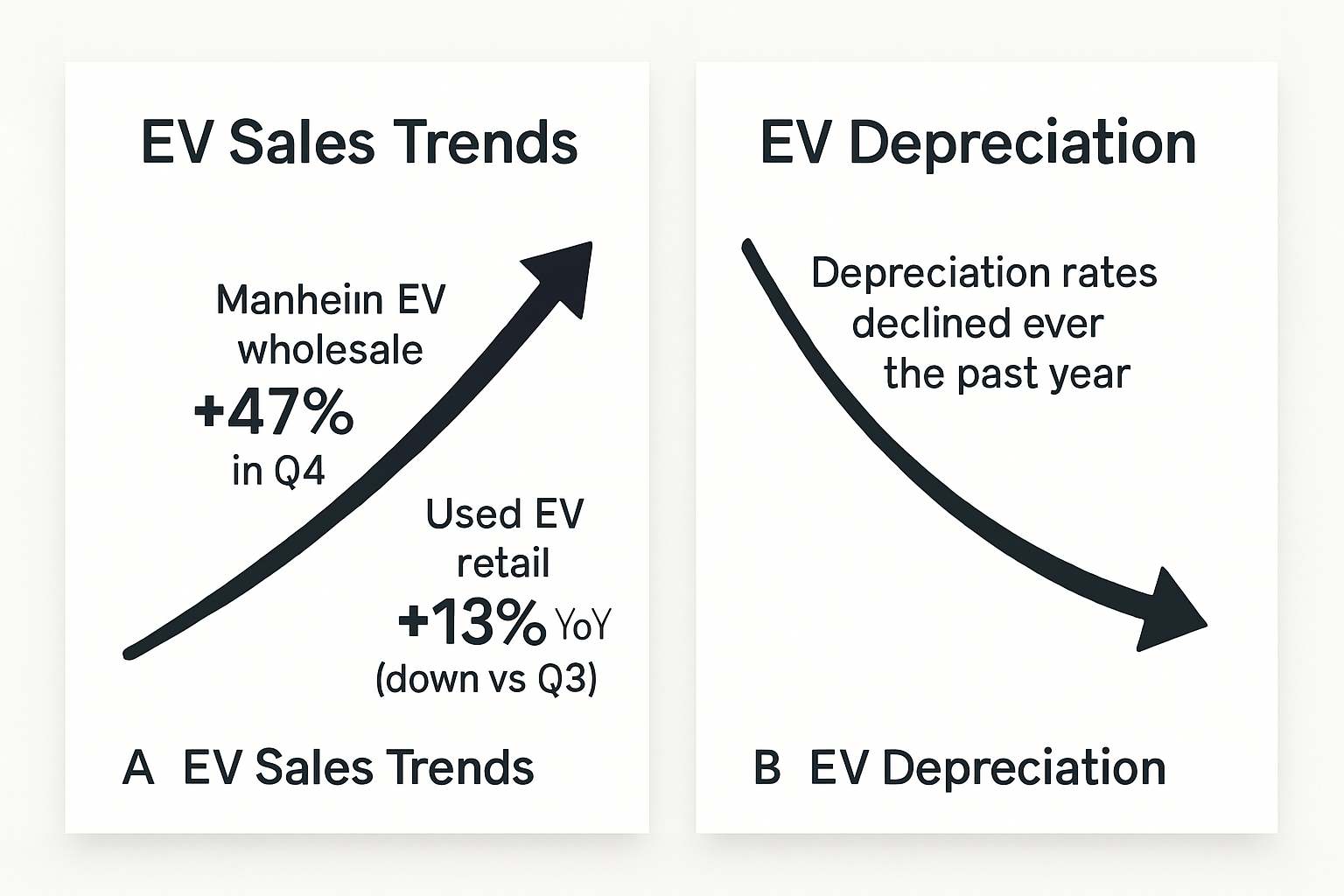

EV Sales & Depreciation: Wholesale Momentum Is Real

- Manheim EV sales rose 47% in Q4

- Used EV retail sales were up 13% YoY, but declined from Q3

- EV depreciation rates declined over the past year as demand for used EVs increased

Translation: EVs are beginning to stabilize — but they still behave differently than ICE cars in pricing, depreciation curves, and buyer confidence.

The Dealer Takeaway: 2026 Requires a Different EV Playbook

A wave of used EVs is coming in 2026 — and EVs don’t behave like ICE vehicles in:

- Depreciation curves

- Risk assessment and reconditioning decisions

- Pricing cadence and market timing

- Auction vs retail strategy

Dealers who understand those differences will find opportunity. Dealers who don’t will feel it in their inventory.

-1.png)

-1.png)